1-855-660-4152 | info@capladder.com

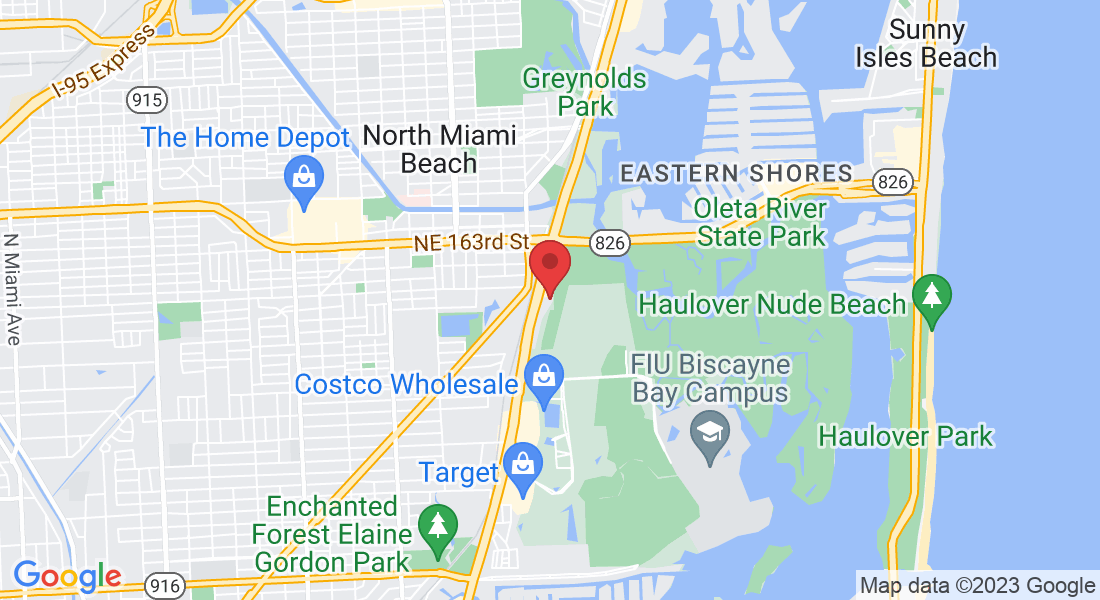

Build Business Credit

Your business credit scores and ratings can play a critical role in your company’s success. The better they are, the better your chances may be for securing the financing, contracts, customers, and supplies you need to grow.

Credit with only Business's EIN

Build your business credit correctly and keep your business and personal credit separate.

Revolving Business Credit Lines

Revolving lines of credit work by allowing you to continue accessing additional funds as you pay your balance down.

Improved Cash-flow Management

A key indicator of the financial health of your business. Positive cash flow can help you pay expenses and invest in new opportunities

Why Small Business Fail?

Top reasons small business fail.

Experience Cash Flow Problems

No Market Need For Product or Service

Runs Out of Cash

Competition

Cash flow is your cash received minus your cash out. It’s what you have available to pay your financial obligations.

Problems occur when you are waiting for payment from a client or vendor and yet you have bills which need to be paid.

You may have a very profitable business but if you don’t have a strong cash flow, or access to capital, you can go under.

Here's what business credit is really about.

We could list hundreds of reasons to get business credit and business financing. We're sure you could, as well.

But here’s what business credit and business financing is really about.

Your Goals

Your Future

Your Prosperity

6 Ideas how Business Credit will help you

Your chances of financial success increase dramatically with CapLadder on your side.

Grow Your Existing Business

Strong credit scores can increase a business’s purchasing power by potentially making it easier and, in most cases, cheaper to secure loans and other financing. It can also be a useful tool for negotiating better terms with vendors.

Start a New Business

A startup business line of credit is a flexible financing product that can help new businesses manage cash flow gaps, as well as pay for short-term working capital needs as expenses for a startup is inevitable.

Hire Additional Employees

If you’re considering bringing on new employees, the first thing to do is to take a look at your business’s credit. In particular, examine your company’s access to additional capital to cover employee wages if the need arises.

New Location

Finding adequate financing is a consistent issue for SMB leaders, especially when they’re ready to grow and open a new business location. Having good business credit will ensure adequate financing is available.

New Equipment

Business equipment can be expensive. Even smaller costs, such as routine maintenance, add up quickly. Equipment financing is a way of reducing the upfront financial burden of buying or replacing business machines.

Marketing

Every business needs to do

marketing to attract customers, increase sales and compete better. But a lot of small business owners struggle to maintain enough cash-flow to sustain an effective marketing campaign.

Who Is

CapLadder?

At CapLadder, our goal is to help ambitious business owners, like you, get the credit and funding they need and deserve. The journey starts by focusing on Credibility. We help companies become extremely attractive to lenders.

We also provide business owners with crucial information about business credit, lines of credit, and business funding. And then we play “matchmaker” by putting business owners in touch with lenders.

Why people love to work with us.

We support and empower small businesses with building business credit & flexible financing solutions with world-class service.

Frequently Ask Question

How do I get Business Credit that's not linked to my SSN?

Just like how consumer credit is linked to your SSN, your business credit is linked to your EIN. This means when applying for business credit, it's usually not required to include your SSN.

Once you properly establish your business entity and Credibility Foundation, you start off building your business credit profile with smaller vendor accounts. As your business pays those retailers you will then qualify for revolving store credit cards, and then cash credit you can use anywhere, just like a normal personal credit card.

Keep in mind that because of federal regulation you will still need to supply a SSN for identity verification purposes. Also providing a personal guarantee can open up even more financing options.

How long will it take me to build Business Credit?

You can qualify for real usable vendor credit immediately. You’ll then start to qualify for store credit within 60-90 days that doesn’t require a personal credit check or personal guarantee.

Within 6 months you should have access to $50,000 in real usable credit, including Visa and MasterCard accounts.

You can then continue to build $100,000-$250,000 or higher in business credit within a year to two.

Is this complicated? Can I really do this?

Every step of the process includes simple education videos and direct resource links so that your business credit building journey is a 'no-brainer'. In the rare occasions that you need help, you have our business credit advisers and finance officers to help!

So as long as you're committed to follow our instructions and are serious about the success of your business, then yes, you really can do this -- even if you're technically challenged.

With that being said, it's important to understand that we do NOT build your business credit FOR you. We help you through simple step-by-step instructions and education. Essentially, follow our instructions and get results.

Can I build my Business Credit on my own?

It's true that between all of our free guides, articles, videos and seminars, you have enough knowledge to go get business credit all on your own. It's also true that we don't hold anything back in our sharing of knowledge because at the core of our company, we want to help as many business owners (and those aspiring-to-be) as possible to have an equal opportunity to succeed and thrive.

With that being said, there still are services you will have to pay for such as 411 listings, business credit monitoring, and a business credit builder so that you're reporting to the right agencies (costing over $3000), not to mention, you'll still have to go out and find vendors and lenders. There are also lots of limitations going this way.

The difference with us is that we have already established countless partnerships and affiliations, which allows us to fully leverage the power of our entire company and client-base for each individual client. Essentially, you get to leverage our company for your benefit. And due to our established credibility in the business credit and financing industry, it's easy for us to expand and constantly add even more funding sources and options, which YOU benefit from. That’s how we have the largest supply of vendors and credit issuers than anywhere else.

In short, if you were to try and get business credit and financing on your own or somewhere else, you'll pay MUCH more than what we ask, and it would take a lot longer. We have this entire process dialed in so that you can get the most amount of funds, in the shortest amount of time, and at the lowest rates possible.Divider

Schedule a free business credit analysis

Our customers Feedback.

Our customers Feedback.

I'm really happy I made the decision to start building my business credit. It's given me the ability to grow and manage my business finance better. The team at CapLadder Partners are very helpful and friendly. Highly recommended & professional.

Joseline Hernandez

New York, America